Web Development

Mobile Development

UX/UI Design

Staff Augmentation

CTO as a Service

Dedicated Team

Low code development

Web Development

Mobile Development

UX/UI Design

Staff Augmentation

CTO as a Service

Dedicated Team

Low code development

Trading Platform Development Services

We develop trading platforms for web and mobile that help users place trades, work with market data, and manage portfolios in real time.

Custom Trading Platform Development Services We Provide

Web Trading Platform Development

Browser-based trading platforms with charts, market data, and full trading functionality for desktop users.

Trading Mobile App Development

Mobile applications for iOS and Android that allow users to trade, track portfolios, and receive real-time updates.

Order and Execution Management Systems (OMS / EMS)

Systems for managing the full order lifecycle, execution logic, and interaction with brokers and liquidity providers.

Market Data, Quotes, and Charting Modules

Integration of real-time and historical market data with interactive charts and analytics tools.

Algorithmic and Automated Trading

We support rule-based and automated trading strategies, including execution logic and performance tracking.

Risk Controls, Limits, and Surveillance

We implement trading limits, exposure controls, and monitoring rules to help reduce operational and market risks.

Portfolio, PnL, and Reporting Dashboards

Dashboards that show positions, profit and loss, and trading performance in real time.

Brokerage, Clearing, and Settlement Integrations

We provide dashboards that display positions, profit and loss, and trading performance in real time.

Migration from Legacy Trading Systems

We offer step-by-step migration from existing platforms, ensuring data validation and minimal disruption.

Support, Maintenance, and SLA

Ongoing technical support, monitoring, and system updates after launch as part of our fintech development services.

Projects delivered by Stubbs

Myntkaup

A cryptocurrency trading platform that allows users in Iceland to trade and manage digital assets securely.

MuesliSwap

A decentralized exchange platform where users can trade, swap, and stake cryptocurrencies directly from their wallets.

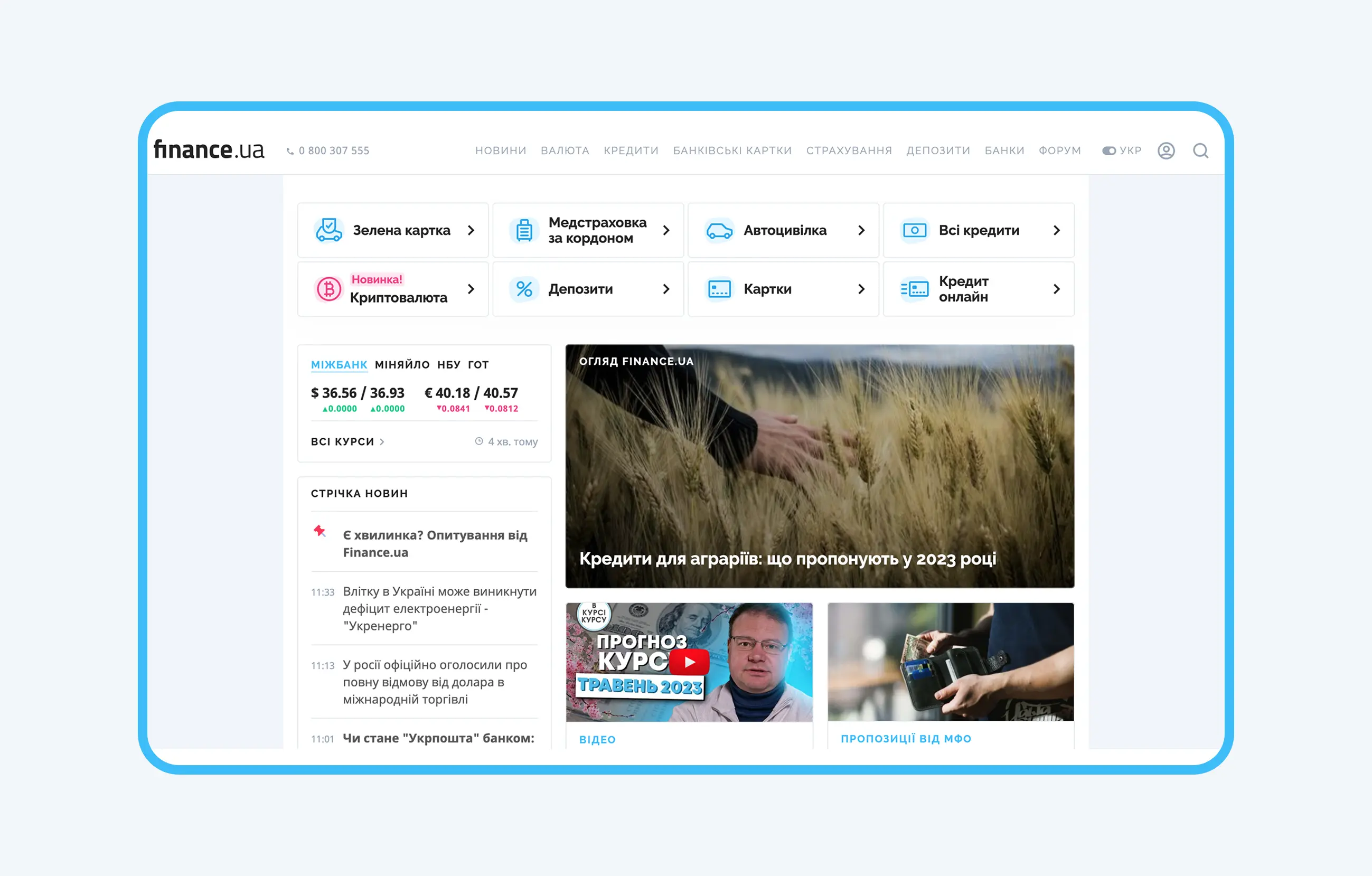

Finance.ua

Ukraine’s leading financial portal with 5 million monthly visitors.

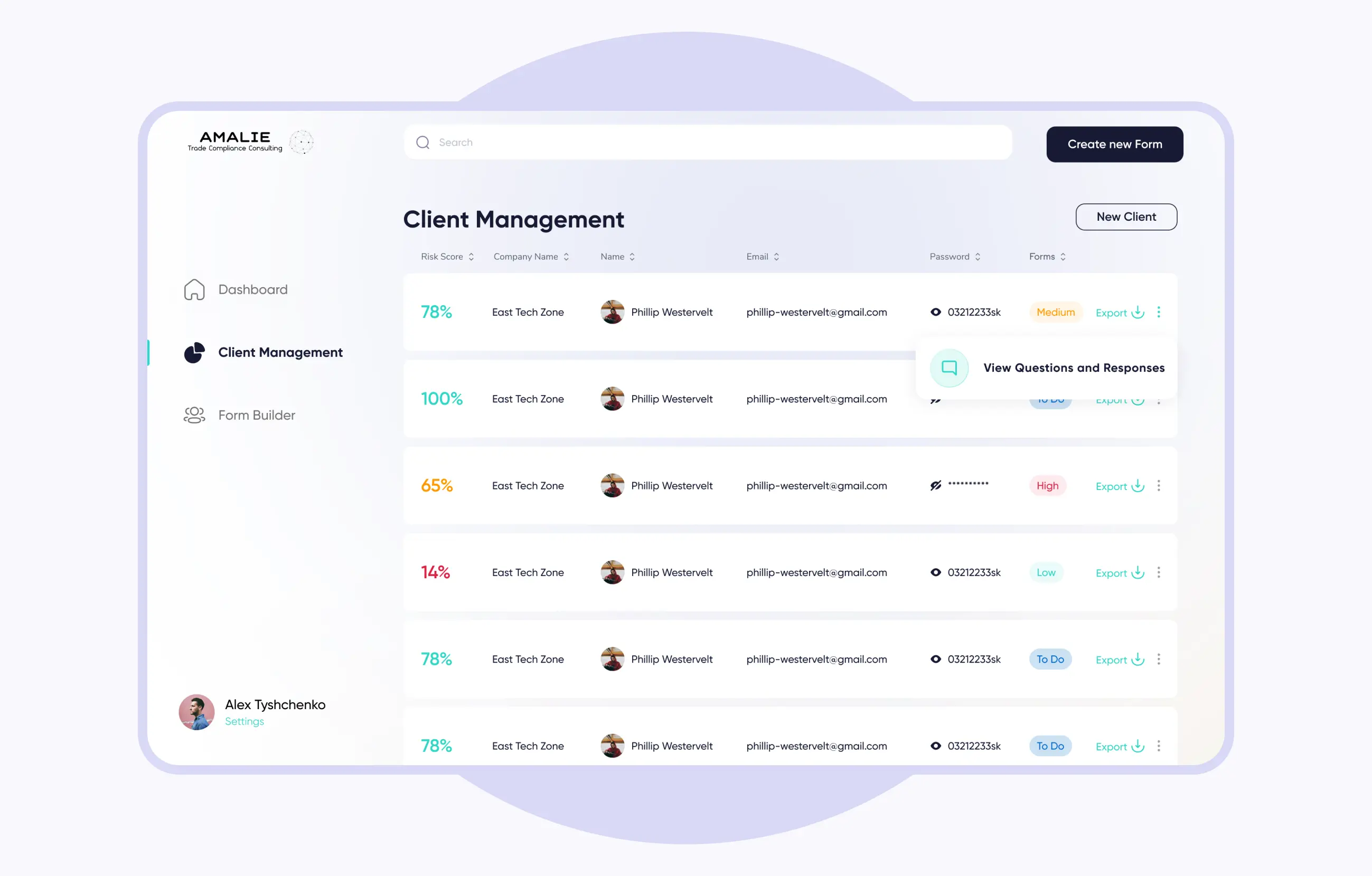

Amalie

Web form builder that automates data collection and risk scoring for a US-based consulting firm

Trading Platform Software Development for Multiple Markets

Equities and ETFs

Trading platforms for stocks and exchange-traded funds that support standard order types and provide live market data.

Options and Derivatives

Support for derivatives trading with advanced order logic and position calculations.

FX and CFDs

Platforms for currency and CFD trading that feature real-time pricing and smooth execution flows.

Fixed Income and Commodities

Systems for trading bonds, commodities, and related instruments.

Cryptocurrency Trading Platform Development

Spot and crypto trading platforms that include wallet connections, balance tracking, and real-time market data.

Core Features for High-Performing Trading Platforms

Real-time Order Entry and Management

Order placement, updates, and cancellations processed instantly with clear system feedback.

Level I / Level II Market Depth

Market depth data that helps traders evaluate liquidity and execution conditions.

Smart Routing and Order Types

Support for standard and advanced order types, including market, limit, OCO, and trailing orders.

Watchlists, Alerts, and News Feeds

Personal watchlists, price alerts, and built-in market news for daily trading workflows.

Backtesting and Paper Trading

Safe environments for testing strategies and practicing trading without using real funds.

Admin Console, Roles, and Audit Trails

Administrative panels with role management and a complete history of system activity.

Stages of work

Architecture and Technology Benefits

1

Low-Latency Event-Driven Design

The system is designed to handle market data and trading events quickly, keeping delays to a minimum.

2

Horizontal Scalability and High Availability

The platform can handle more trades as volume increases and remains reliable even when activity is high.

3

Modular Services for Faster Releases

Because services are separate, new features can be added or updated without stopping trading.

4

Observability and SRE-ready Operations

With built-in monitoring and metrics, teams can keep an eye on system health and fix problems early.

Integrations for Trading Platforms

Broker and Clearing APIs

Connections with brokers to support order execution, account management, and funding flows.

Market Data Providers and Aggregators

Integration with vendors that supply real-time quotes, tick data, and historical market information.

KYC, AML, and Identity Verification

Onboarding flows with identity checks and compliance-related validations.

Payments, Banking, and Open Banking

Support for deposits, withdrawals, and bank connections used within trading platforms.

Analytics, Data Warehouse, and BI

Trading data can be exported into analytics systems for reporting and operational insights.

Security and Regulatory Compliance

1

Authentication, MFA, Session Security

Secure login flows and controlled user sessions.

2

Encryption in Transit and at Rest

Protection of sensitive trading and personal data.

3

Compliance Support

System architecture aligned with common regulatory and audit requirements.

4

Monitoring, Logging, Incident Response

Operational logs and alerts for fast issue detection.

Trading Platform Development Company — Why Choose Us

1

Capital Markets Domain Expertise

Our team works with trading workflows, market data, and execution logic on a daily basis.

2

Compliance-Ready Delivery and Security by Design

Security, access control, and regulatory requirements are considered from the very beginning.

3

Proven Low-Latency Implementations

We design architectures focused on fast data processing and stable order execution. This allows trading platforms to stay responsive even during peak market activity.

4

Flexible Engagement Models

You can work with a dedicated development team, extend your in-house engineers, or start with a fixed-scope project.

5

Transparent SLAs and Ongoing Support

Clear communication and long-term technical support.

Trading Platform Development Cost — What Drives Budget

1

Feature Scope and Order Types

If your platform needs advanced trading logic and more order types, development and testing will take longer.

2

Real-time Data Depth and Provider Fees

The amount of market data and how often it updates will impact your system’s design and ongoing costs.

3

Compliance Scope and Security Audits

Regulatory and security requirements influence both timelines and overall project effort.

4

Integrations, Latency Targets, and Hosting Regions

Your target markets, performance needs, and hosting locations will guide your infrastructure choices.

FAQs

What does custom trading platform development include end to end?

We handle everything from product design and core trading logic to backend services, third-party integrations, security setup, and post-launch support.

How long does a trading platform MVP take to build?

Building most MVPs takes a few months, but the exact timeline depends on the trading features, data providers, and integrations you need.

What impacts trading platform development cost the most?

Order complexity, the depth of market data, compliance needs, and performance expectations are the main factors that affect cost.

Which broker and market data integrations do you support?

The integrations we support depend on your target region and the providers you choose for your platform.

How do you ensure low latency and platform scalability?

We ensure low latency and scalability by designing event-driven systems, optimizing data flows, and using infrastructure that grows with your trading volume.

Can you implement OMS / EMS with advanced order types?

Yes, our platforms support complex order logic, conditional orders, and advanced execution workflows.

Do you deliver cryptocurrency trading platform development?

Yes, we build cryptocurrency trading platforms that include spot trading, wallet integration, and real-time market data.

How do you handle KYC, AML, and regulatory requirements?

We include compliance and verification processes as part of the platform’s core design.

Can you migrate from a legacy system without downtime?

We handle migration step by step, running old and new systems in parallel until everything is stable.

What post-launch maintenance and SLAs do you provide?

After launch, we offer monitoring, updates, and ongoing technical support as outlined in our service agreements.

We would love to help.

What are you interested in:

Name

Phone

Tell us about your project and goals

0/1000

Add your file