Web Development

Mobile Development

UX/UI Design

Staff Augmentation

CTO as a Service

Dedicated Team

Low code development

Web Development

Mobile Development

UX/UI Design

Staff Augmentation

CTO as a Service

Dedicated Team

Low code development

Fintech Development Company

We build secure, scalable fintech platforms for fast-growing and enterprise-level clients. Our team develops payment infrastructure, automates financial workflows, integrates with banking systems, and helps products support both fiat and crypto payments.

Fintech App Development Services We Offer

Integration with Accounting

We connect your platform with Xero, QuickBooks, and ClickBooks to automate bookkeeping, make reporting easier, and give you real-time financial insights.

Custom Financial Dashboards

We create dashboards that show your income, expenses, balances, and key financial metrics, all updated in real time.

Web3 Solutions for Banks

We implement Web3 components for secure digital asset management, on-chain transactions, and blockchain-based payment systems.

Digital Wallet Integration

We add support for MetaMask, Trust Wallet, and other digital wallets so users can securely store and manage their assets.

Secure Payment Processing

We configure payment flows that support multiple currencies, subscriptions, recurring charges and BNPL options.

Banking & Trading API Integrations

We link your system to banking APIs, trading platforms, and market data providers to automate your financial operations.

Projects delivered by Our Team

Myntkaup

A cryptocurrency trading platform that allows users in Iceland to trade and manage digital assets securely.

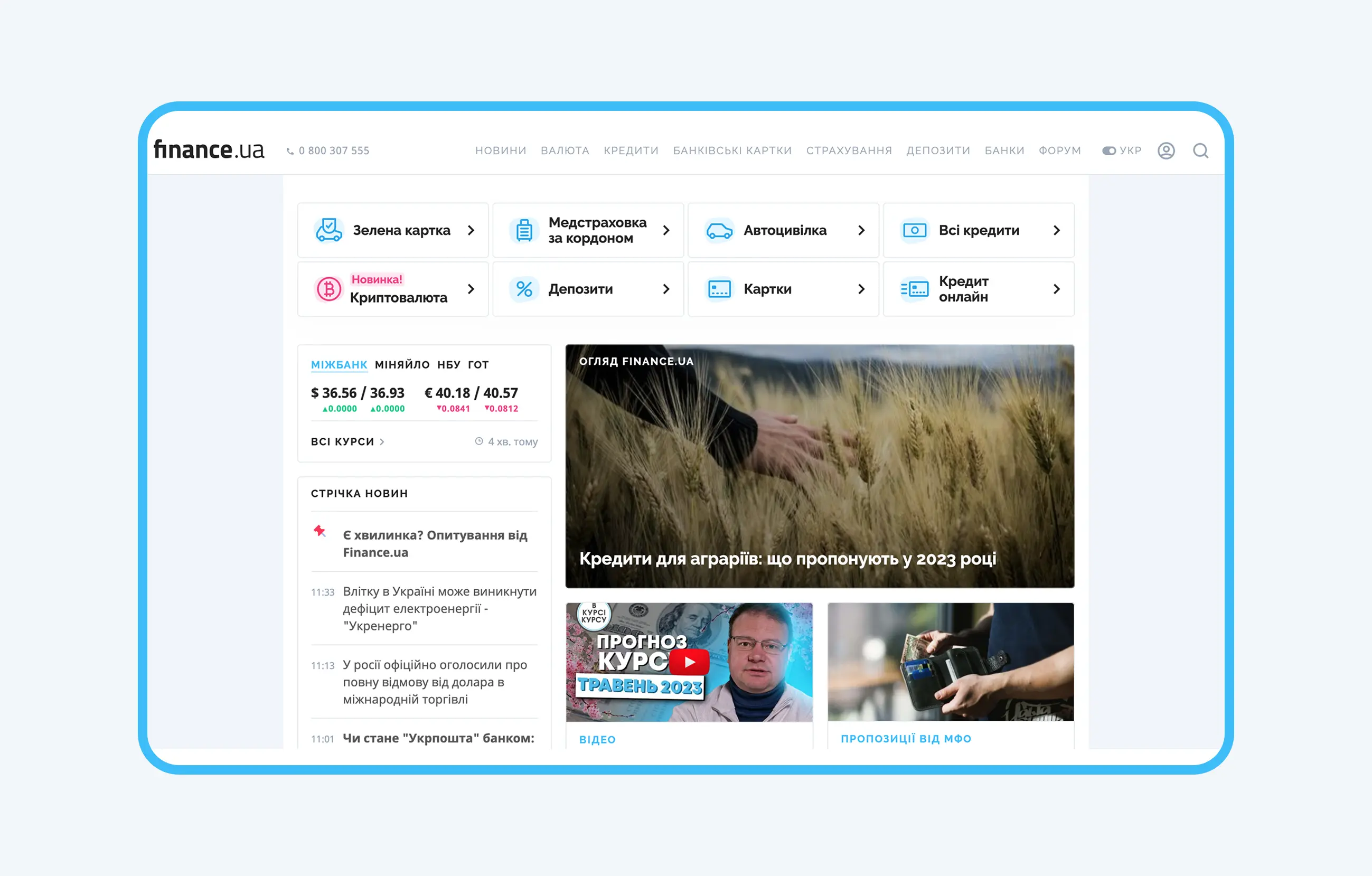

Finance.ua

Ukraine’s leading financial portal with 5 million monthly visitors.

MuesliSwap

A decentralized exchange platform where users can trade, swap, and stake cryptocurrencies directly from their wallets.

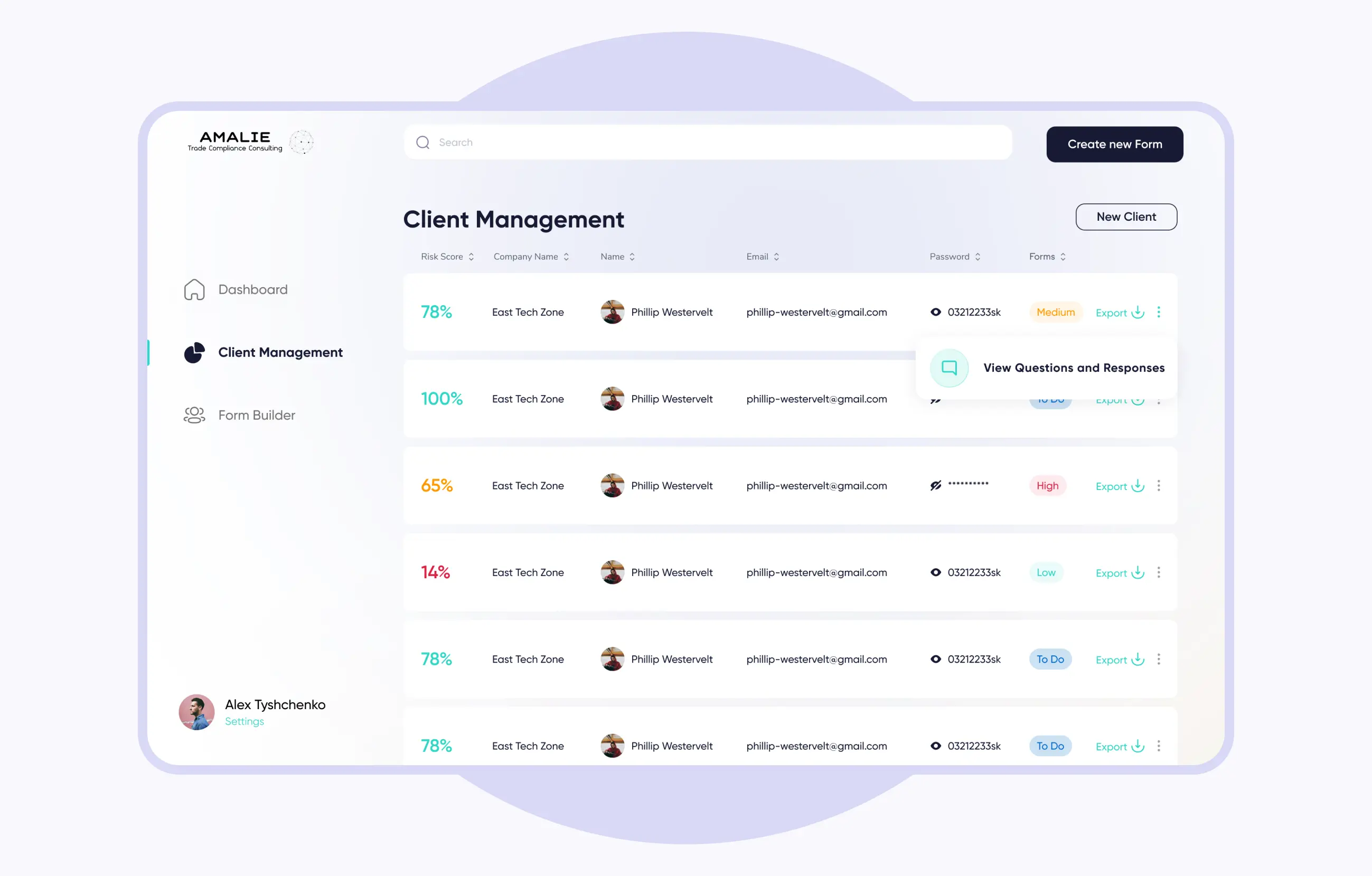

Amalie

Web form builder that automates data collection and risk scoring for a US-based consulting firm

Security and Compliance Standards

Data Protection

We follow strict security practices to keep financial data safe. This includes encrypted communication, secure storage, and controlled access to sensitive information.

Compliance-Ready Architecture

The systems we build follow the requirements of GDPR, PCI DSS, PSD2 and other financial regulations. We plan the architecture so it meets current standards and can be updated easily if new regulations appear.

Fraud Detection and KYC/AML

Our products can include user verification, transaction checks and automated monitoring. These features help reduce fraud risks and support proper KYC and AML processes.

Team

Technologies We Use

Front-end

Back-end

Mobile

Server

CMS

QA

Integrations

Get a Technical Consultation with Senior Fintech Developers

Collaborate with an experienced fintech app development company to create a compliant, efficient, and innovative solution.

Why Choose Our Financial Services Software Development Company?

1

Skilled and Experienced Team

Our team consists of senior and mid-level engineers with an average of 5 years of experience in fintech development. 100+ successful projects give us the background to handle complex systems and integrations.

2

Expertise in FinTech Solutions

We work with accounting tools, payment services, dashboards and Web3 features. Our experience includes high-traffic financial platforms with millions of monthly users and large crypto products serving multi-million customer bases.

3

Modern Tech Stack and Tools

Our stack includes Node.js, NestJS, PostgreSQL, MongoDB, and cloud platforms. It gives us the tools to deliver fast and reliable financial applications.

4

Flexible Cooperation Models

You can choose the format that fits your business: dedicated specialists, full-cycle development or long-term product support.

Industries We Serve

Banking and Payments

We help banks and payment companies launch or upgrade digital services. Online banking, transfers, onboarding, and multi-currency payments work smoothly and stay compliant.

Investment and Wealth Management

We create tools that show portfolio performance, market changes, and client activity clearly, helping teams make informed decisions.

Insurance and Insurtech

Claims, policy changes, and customer requests become easier to manage when these processes are handled through a modern digital system.

Lending and Credit Platforms

Our lending solutions automate scoring, reviews, loan management, and repayments. Approvals become faster, and the process stays transparent.

Regulatory and Compliance Tools

We develop solutions for AML and KYC checks, transaction monitoring, and accurate reporting so your platform stays compliant and protects sensitive financial information.

FAQs

How long does it take to develop a custom Fintech application?

A prototype can be built in two to six weeks. An MVP usually takes three to six months. A full product may need six months or more if the system is complex. After we review your requirements, we’ll confirm the exact timeline.

How do you ensure security and compliance in Fintech software development?

We follow industry standards from the first planning steps. All products include secure data storage, encrypted communication, role-based access, and safe authentication. We also design the architecture to support GDPR, PCI DSS, PSD2, and other regulations that apply to your market.

What technologies do you use for fintech app development services?

Our stack includes React, Next.js, Node.js, NestJS, PostgreSQL, MongoDB, and cloud platforms like AWS. For financial workflows we also work with banking APIs, payment gateways, Web3 tools, and KYC or AML providers.

Can you integrate our Fintech app with existing financial systems and APIs?

Yes. We work with accounting tools, payment services, trading platforms, Web3 wallets, core banking systems, and third-party APIs. If you already use specific services, we can connect your app to them.

How do you estimate the cost of custom fintech software development?

We calculate the cost based on the project scope, required features, integrations, and complexity. After a short call and a review of your requirements, we prepare a detailed estimate so you understand the timeline and budget before development begins.

Do you offer ongoing maintenance and support for Fintech platforms?

Yes, we do. Our team handles updates, monitors performance, fixes issues, and improves security. Many clients stay with us long term so their platform continues to run smoothly and grow with their product.

Can you help modernize or rebuild legacy financial software?

Absolutely. We can move outdated systems to a modern stack, fix technical debt, redesign the architecture, or rebuild the product while keeping your key business logic.

How do you handle scalability and performance for financial applications?

We design systems to handle more transactions and spikes in user activity. This includes optimized databases, load balancing, caching, cloud scaling, and performance monitoring to keep your platform fast and reliable.

We would love to help.

What are you interested in:

Name

Phone

Tell us about your project and goals

0/1000

Add your file

-1747731627136.png)

-1749023935755.png)

-1747731983305.png)

-1747732042514.png)

-1747732097673.png)

-1747732122263.png)

-1747732160762.png)

-1747732191631.png)