Web Development

Mobile Development

UX/UI Design

Staff Augmentation

CTO as a Service

Dedicated Team

Low code development

Web Development

Mobile Development

UX/UI Design

Staff Augmentation

CTO as a Service

Dedicated Team

Low code development

Investment Software Development Services

Custom investment software that helps teams manage portfolios, analyze performance, and streamline investment workflows.

Investment Software Development Services We Provide

Custom Investment Platform Development

We build investment platforms that fit your product logic, asset structure, and internal processes.

Portfolio Management Software Development

Tools for managing portfolios, positions, allocations, and historical performance in one system.

Investment Analytics and Insights Modules

Analytics modules that help teams understand performance, risk exposure, and portfolio behavior.

Order Management System (OMS) Development

Order workflows covering creation, allocation, execution tracking, and long-term record keeping.

Risk Management and Compliance Modules

We include risk rules, exposure controls, and monitoring tools directly in your daily investment workflows.

Investor Onboarding with KYC and AML

Digital onboarding with identity verification, document collection, and compliance checks.

Reporting, Statements, and Billing Engine

We automate reporting, fee calculations, and client statements to match your pricing model.

Data Migration and Platform Modernization

We move your portfolios, transactions, and client data from old systems to new ones.

Support and Maintenance Services

We provide ongoing technical support, regular updates, and keep your system stable.

Projects Delivered by Stubbs Team

Myntkaup

A cryptocurrency trading platform that allows users in Iceland to trade and manage digital assets securely.

MuesliSwap

A decentralized exchange platform where users can trade, swap, and stake cryptocurrencies directly from their wallets.

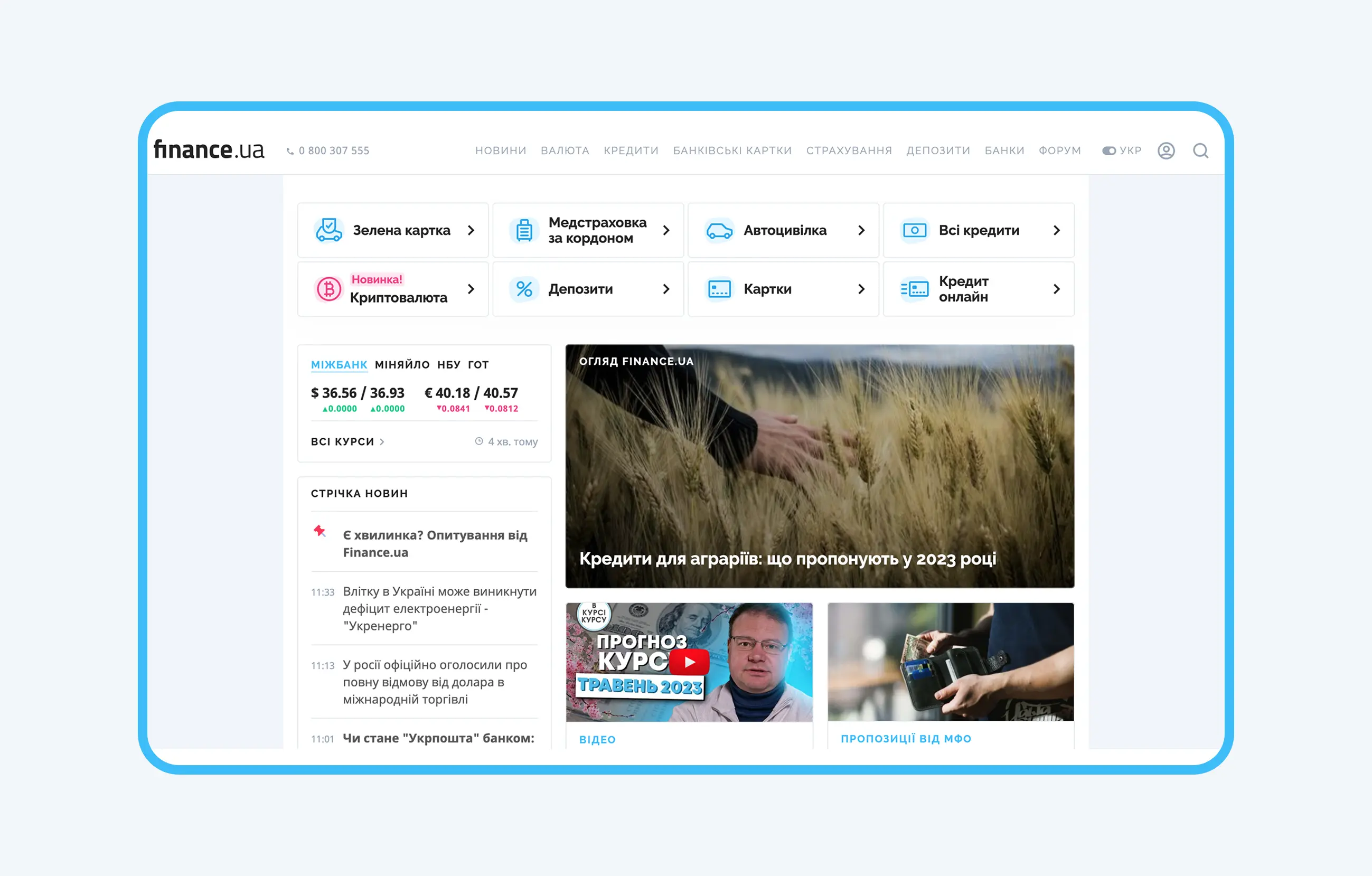

Finance.ua

Ukraine’s leading financial portal with 5 million monthly visitors.

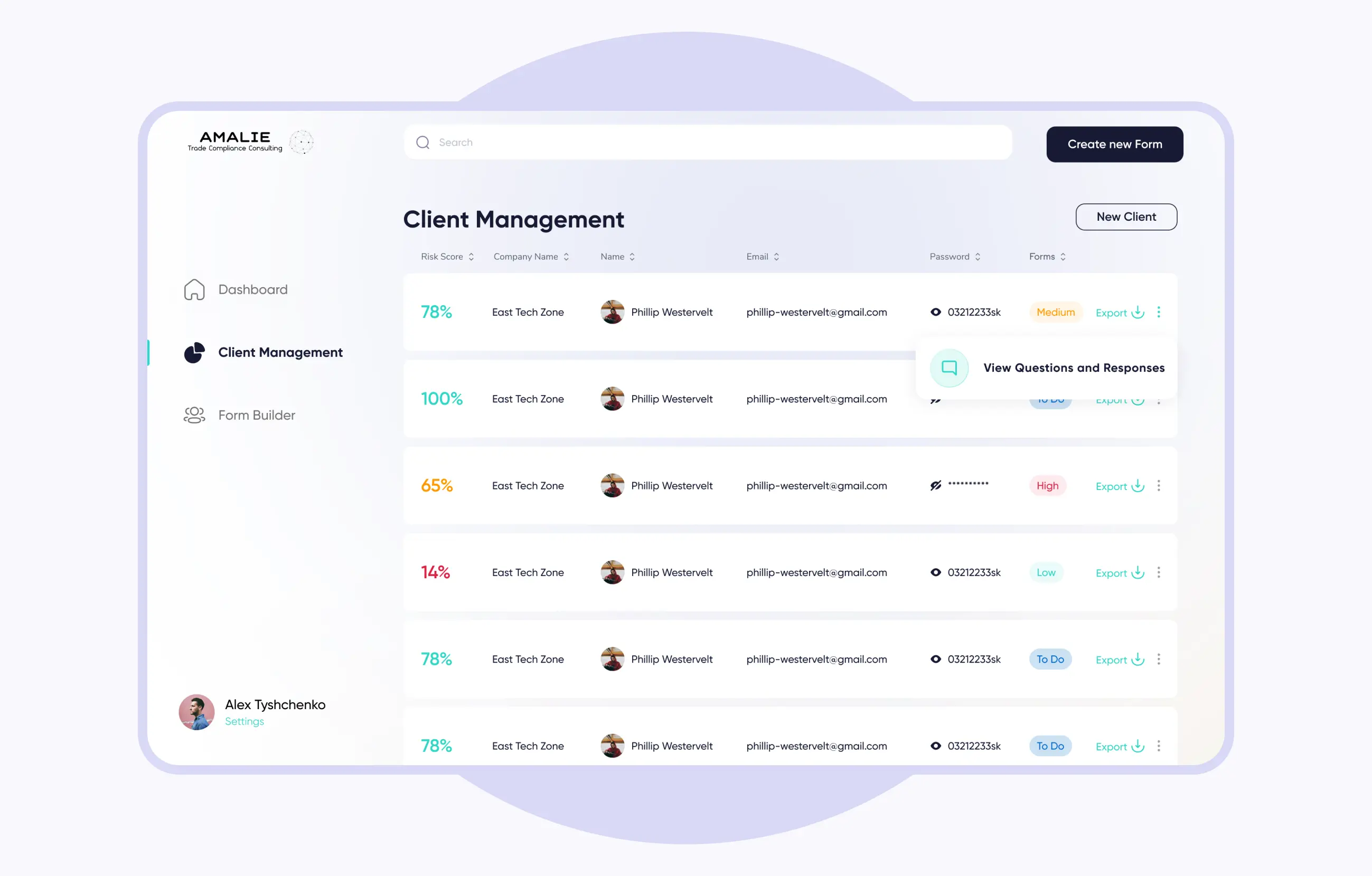

Amalie

Web form builder that automates data collection and risk scoring for a US-based consulting firm

Investment Solutions We Build

Robo-Advisor Platforms

Automated investment systems that use goals, risk profiles, and allocation rules to manage portfolios with minimal manual involvement.

Portfolio Rebalancing Tools

Tools for monitoring portfolio drift and rebalancing allocations either automatically or through manual controls.

Wealth Management Portals

Web platforms for advisors and clients to review portfolios, access documents, and track investment performance.

Fund Administration Systems

Software for managing funds, calculating NAV, and handling reporting and operational processes.

Asset Allocation and Optimization Engines

Allocation logic built around diversification principles, risk thresholds, and investment strategy.

Performance Measurement and Attribution

Detailed breakdowns that show how returns are formed across assets and decisions.

Alternative Investments Platforms

Support for private assets, funds, and investment instruments outside traditional markets.

Investor Portals and Self-Service Apps

Secure client-facing applications for viewing portfolios, statements, and transaction history.

ESG Scoring and Sustainability Reporting

Tracking ESG indicators and presenting sustainability metrics within investment reports.

Get a Technical Consultation with Senior Investment Software Engineers

Discuss your product idea, integrations, and technical approach before development starts.

Core Features for Investment Platform Development

Goals, Risk Profiles, and Suitability

Centralized management of client goals, risk tolerance, and suitability rules.

Model Portfolios and Sleeve Accounting

Support for model-driven portfolios and multi-strategy account structures.

Orders, Allocations, and Trade Blotter

Clear visibility into orders, allocation logic, and full trade history.

Real-Time Market Data and Charting

Live pricing, interactive charts, and access to historical market data.

Fee Calculation and Invoicing

Configurable fee structures with automated invoice generation.

Multi-Currency, FX, and Corporate Actions

Handling of currency conversion, exchange rates, and corporate events.

Document Vault and e-Signature

Secure storage of investment documents with approval and signing workflows.

Roles, Permissions, and Audit Trails

Access control and detailed logs of user activity across the platform.

Stages of work

Integrations for Investment Management Software

Custodians and Brokers

Account opening, balances, trades, and custody data integration.

Market Data Providers and News Feeds

Quotes, fundamentals, historical data, and market news.

CRM and Productivity Suites

Sync with CRM systems and internal tools used by investment teams.

Banking, Payments, Open Banking Feeds

Transaction data, funding flows, and bank connectivity.

Accounting and Tax Systems

Data exchange with accounting platforms and tax tools.

Identity, KYC, AML, and Fraud Services

Integration with verification and compliance providers.

Tech Stack for Investment Software Development

Front-end

Back-end

Mobile

Server

CMS

QA

Integrations

Security and Regulatory Compliance

1

MFA, Session Security, Access Control

Role-based access, session management, and authentication layers.

2

Encryption in Transit and at Rest

Protection of sensitive financial and personal data.

3

Regulatory Readiness

Architecture designed to support common regulatory and audit requirements.

4

Logging, Monitoring, Incident Response

System logs, alerts, and monitoring for operational control.

5

Vendor Risk, Backups, Disaster Recovery

Data protection strategies and recovery planning.

Team

Investment Software Development Cost — Key Drivers

1

Feature Scope and Trading Complexity

The more advanced the portfolio logic, trading rules, and automation, the more time is required for implementation and testing.

2

Number of Integrations and Data Providers

Each custodian, broker, or data provider comes with its own APIs, data formats, and edge cases that must be handled carefully.

3

Compliance Requirements and Certifications

Regulatory rules shape how the system is designed, what documentation is needed, and how long delivery will take.

4

Performance Targets, Regions, and Hosting Model

Supporting multiple regions, meeting availability needs, and choosing a hosting setup all have a direct impact on infrastructure costs.

Why Choose Our Investment Software Development Company

1

Domain Expertise in Investment and Wealth Management

Our team works with investment platforms, portfolio tools, and financial data as part of broader fintech development services.

2

Compliance-Ready Delivery and Security by Design

We build security and access controls into every project from the very beginning.

3

Proven Integrations with Custodians and Data Vendors

We have hands-on experience connecting brokers, custodians, and data providers.

4

Flexible Engagement Models

Dedicated teams, team extension, or fixed-scope delivery depending on project needs.

5

Transparent SLAs and Post-Launch Support

Ongoing involvement to support stability and long-term platform growth.

Industries We Serve

Asset Managers and RIAs

We work with asset managers and registered investment advisors who need reliable tools for portfolio management, reporting, and client communication.

Broker-Dealers

Our experience includes building systems that support trading operations, compliance workflows, and day-to-day brokerage processes.

Family Offices

We develop software for family offices that manage complex portfolios, multiple accounts, and long-term investment strategies.

Private Banks and Wealth Units

We help private banking teams manage client data, portfolios, and reporting in a structured and secure way.

Fintech Startups

We support fintech startups building investment products, from early MVPs to scalable platforms ready for growth.

FAQs

What does an investment software development company deliver end to end?

We handle the entire development cycle, starting with discovery and UX design, then moving through integrations, security setup, launch, and ongoing technical support.

How long does investment platform development take for an MVP?

Most MVPs are ready in a few months. The exact timeline depends on your portfolio logic, data sources, and the integrations you need.

Which custodians, brokers, and data providers can you integrate?

The options depend on your region and business model. We support the most widely used custodians, brokers, and market data providers.s, brokers, and market data providers.

How do you ensure regulatory compliance for SEC, FINRA, or MiFID II?

We design compliance into the system by setting up data handling rules, access controls, and audit-ready features.ontrol, and audit-ready system design.

Can you build portfolio rebalancing, performance, and attribution?

Yes, we can. Our solutions include rule-based rebalancing, portfolio analytics, and clear performance attribution.cs, and clear performance attribution.

What impacts investment software development cost the most?

The main factors are your portfolio’s complexity, the number of integrations, your compliance needs, and the depth of reporting you require.

Can you migrate data from legacy portfolio systems safely?

Yes, we migrate your data one step at a time. We use validation and reconciliation to make sure your historical data stays safe.

How do you secure investor data and advisor workflows?

We keep your data and workflows secure with role-based access, encryption, activity logs, and clear user permissions.

Do you offer ongoing maintenance and SLA-based support?

Yes, after launch we provide monitoring, updates, and long-term technical support based on agreed SLAs.

We would love to help.

What are you interested in:

Name

Phone

Tell us about your project and goals

0/1000

Add your file

-1747731627136.png)

-1749023935755.png)

-1747731983305.png)

-1747732042514.png)

-1747732097673.png)

-1747732122263.png)

-1747732160762.png)

-1747732191631.png)