Web Development

Mobile Development

UX/UI Design

Staff Augmentation

CTO as a Service

Dedicated Team

Low code development

Web Development

Mobile Development

UX/UI Design

Staff Augmentation

CTO as a Service

Dedicated Team

Low code development

Fintech UX/UI Design Company for Banking and Financial Services

We design fintech interfaces that are simple, reliable, and easy for anyone to use. Our team helps banks and financial companies turn complicated processes into digital experiences users can rely on.

Solutions for Both Banks and Fintech Innovators

UX Strategy for Financial Services

User flows and product logic are shaped around real financial behavior, business goals, and regulatory constraints.

UX Research and Customer Insights

We explore user behavior and friction points through interviews, analytics, and product data.

UI Design and Design Systems

We design clear interfaces and scalable design systems for complex financial products.

Product Vision, Roadmaps, and Prioritization

Feature structure and priorities are shaped around business goals and compliance requirements.

Conversion and Onboarding Optimization

We simplify onboarding flows and reduce friction on the way to the first successful transaction.

Accessibility and Inclusive Design

We design interfaces that work for people of all ages and abilities, meeting accessibility standards.

Compliance by Design: KYC, AML, PSD2, SCA, GDPR

We design UX flows that support regulatory steps without breaking the user experience.

AI-Driven Personalization and Copilot UX

Personalization and assistant features are designed to support confident user decisions.

Enhance Your Fintech and Banking Experiences Through UX Design

Get expert feedback on your fintech product UX.

Name

Impact and ROI

1

Reduce Time to Transaction

Clear user flows and simplified decision paths help users complete financial actions faster.

2

Increase Activation and Retention

Well-structured onboarding and a consistent user experience boost early engagement and keep users coming back.

3

Lift in Conversion and NPS

Smart interface choices make things easier for users and build trust when it matters most.

4

Lower Support Costs through Better UX

Clear flows, understandable actions, and better feedback reduce user errors and support requests.

Fintech and Banking Case Studies

Myntkaup

A cryptocurrency trading platform that allows users in Iceland to trade and manage digital assets securely.

MuesliSwap

A decentralized exchange platform where users can trade, swap, and stake cryptocurrencies directly from their wallets.

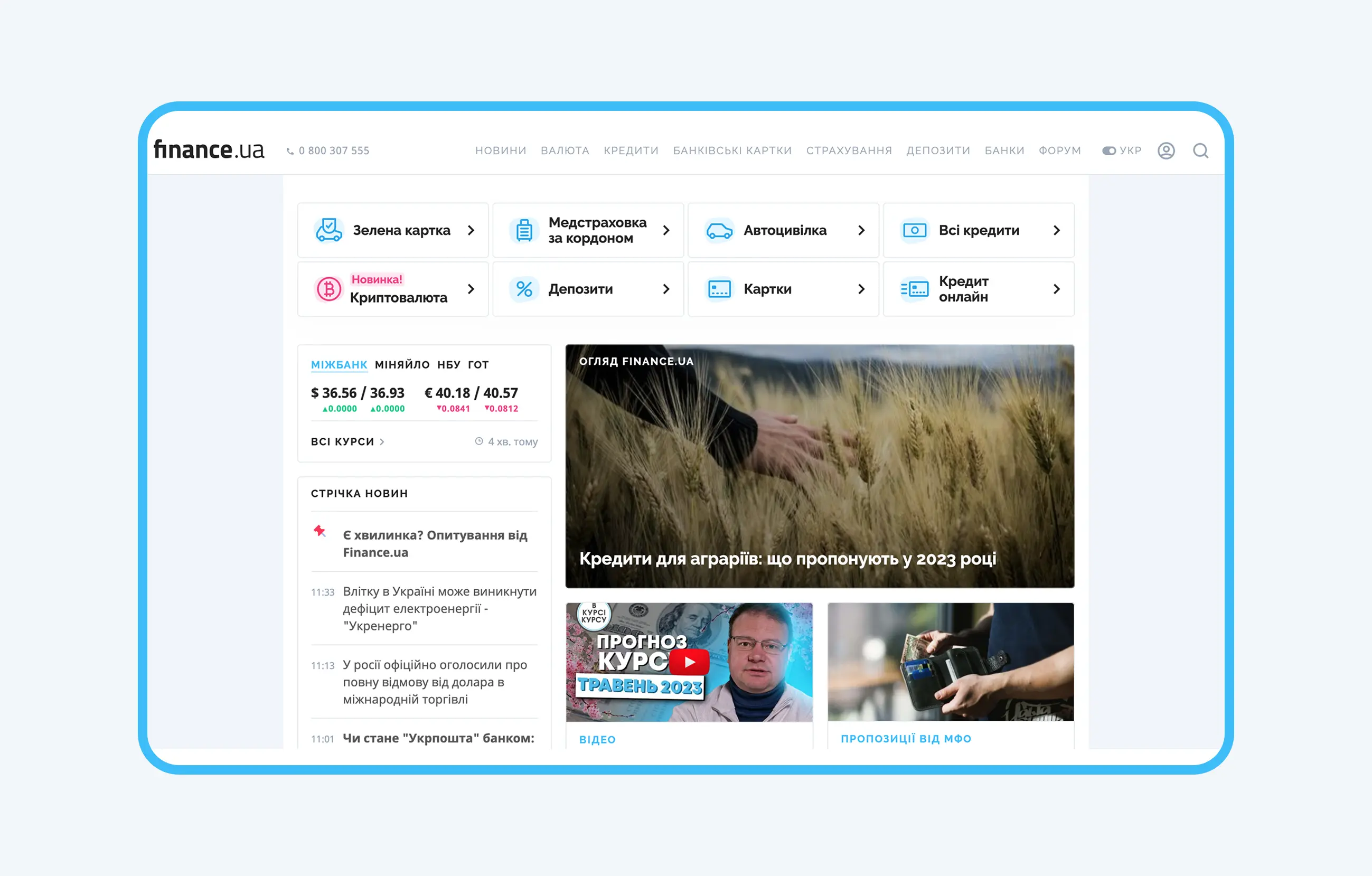

Finance.ua

Ukraine’s leading financial portal with 5 million monthly visitors.

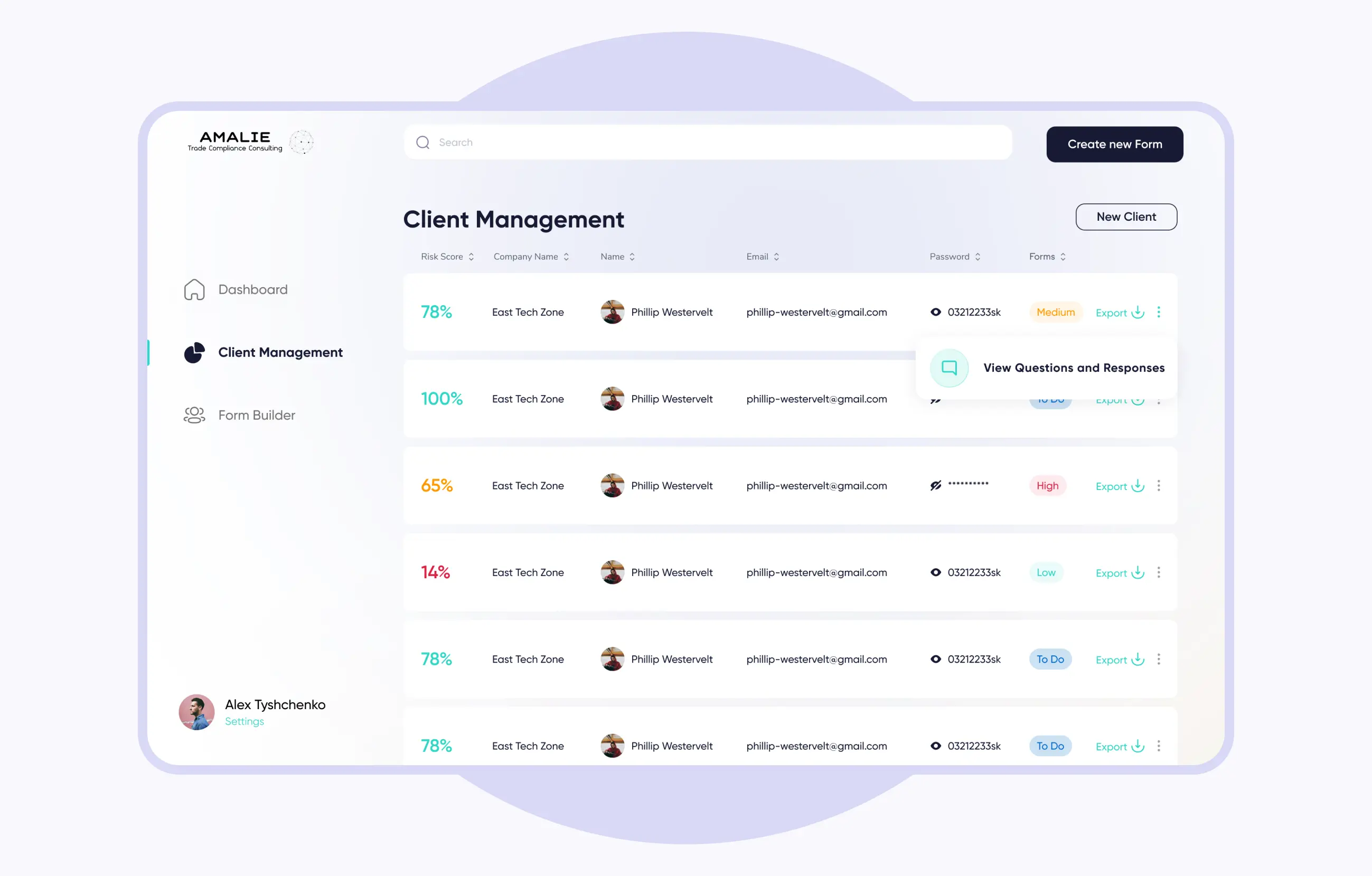

Amalie

Web form builder that automates data collection and risk scoring for a US-based consulting firm

Services by Growth Stage

For Enterprise and Banks

UX design for large financial organizations with complex structures, many user roles, and strict regulations. Our focus is on clarity, consistency, and long-term maintainability.

For Startups and Scaleups

We support teams building new fintech products or growing existing ones. Our help covers MVP design, onboarding flows, early testing, and getting ready for product growth.

Our Fintech UX Process

1

Discovery and Stakeholder Alignment

At the beginning, we clarify your product goals, business needs, and regulatory limits so everyone is on the same page.

2

Research: Interviews, Surveys, and Analytics

User behavior, feedback, and product data help identify risks, friction points, and opportunities.

3

Information Architecture and Flows

Complex financial logic is turned into clear steps so users always understand what to do next and why.

4

Wireframes and Prototypes

Flows are tested early to validate logic, reduce rework, and avoid costly changes during development.

5

Usability Testing and Iteration

Design decisions are validated through testing and refined based on real user feedback.

6

Visual Design and Microinteractions

Interfaces reinforce trust, clarity, and confidence during critical financial actions.

7

Design System and Handover

Design guidelines and documentation help development teams implement and scale the product consistently as part of broader fintech development services.

Where We Focus

Digital Banking

UX design for mobile and web banking products focused on clarity, trust, and everyday financial actions.

Payments

Design of payment flows, checkout experiences, and transaction confirmations.

Wealth and Investing

Interfaces for portfolio management, analytics, and investment operations.

Lending Platforms

User flows for loan applications, approvals, and repayment management.

BNPL and Embedded Finance

Design of embedded finance experiences that fit naturally into user journeys.

Crypto and DeFi

UX for wallets, trading, and on-chain actions with strong emphasis on clarity, safety, and risk awareness.

Compliance and RegTech

Interfaces for verification, monitoring, and regulatory workflows.

Insurance and Insurtech

UX design for policy management, claims, and customer portals.

Financial Infrastructure and APIs

Design of dashboards, admin panels, and developer-facing tools for financial platforms and integrations

Thought Leadership in Financial UX

1

Customers Flip Banking Inside Out

Financial UX has a direct impact on trust, confidence, and decision-making at every important step.

2

Executive Buy-In for UX and Brand in Banking

In regulated products, clarity and predictability matter more than visual speed or interface effects.

3

Ten Misconceptions Killing Digital Banks

Most users drop off during onboarding, verification, or their first transactions.

4

Fintech UX Trends and 2026 Outlook

Regulation, AI adoption, and embedded finance continue to redefine financial user experiences.

Get a Consultation with Senior Fintech UX Designers

Discuss your product goals, UX challenges, and compliance requirements with senior designers experienced in fintech and banking interfaces.

Team and Engagement

1

Senior Fintech Designers and Researchers

Work is handled by senior UX designers and researchers with hands-on experience in fintech, banking, and regulated digital products.

2

Engagement Models and Timelines

We can start with a focused audit or provide long-term product design support, depending on your business needs and goals.

3

Book a UX Audit or Discovery Workshop

A structured audit or discovery session helps you spot UX risks, compliance gaps, and growth opportunities before you start development.

FAQs

What makes fintech and banking UX different from other industries?

Fintech UX must balance usability with regulation. User flows often include identity checks, security steps, and legal requirements that cannot be skipped. Good financial UX explains complex actions clearly and builds trust at every step.

What is your typical UX process for financial products?

The process usually includes discovery, research, flow design, wireframes, prototyping, usability testing, and design system preparation.

How do you address compliance and security within UX work?

UX decisions account for regulatory requirements such as KYC, AML, GDPR, and strong customer authentication from the early stages.

Do you work with both startups and enterprise banks?

Yes, we work with both early-stage fintech products and large enterprise platforms. Our approach adapts to your needs, but we always focus on clarity, reducing risk, and scalability.

Can you improve activation, conversion, and retention metrics?

Yes. Our UX improvements make onboarding smoother, clarify key actions, and simplify important user flows. This helps users complete their first transaction faster and stay engaged longer.

How long does a fintech UX engagement take and what does it cost?

Timelines depend on scope. A UX audit may take a few weeks, while full product design can extend over several months.

Can you collaborate with in-house product and engineering teams?

Yes. Our designers work closely with your internal teams, product managers, and developers to make sure handoff is smooth and implementation is realistic.

Do you create design systems for regulated environments?

Yes. Our design systems are built to support consistency, scalability, and compliance.

What regions and languages do you support for research?

We can do research in different markets based on where your product is used. This includes multilingual testing and understanding region-specific behaviors.

How do you measure ROI of UX in financial services?

Results are tracked through product metrics such as activation rate, task completion, drop-off reduction, and support load.

We would love to help.

What are you interested in:

Name

Phone

Tell us about your project and goals

0/1000

Add your file