Web Development

Mobile Development

UX/UI Design

Staff Augmentation

CTO as a Service

Dedicated Team

Low code development

Web Development

Mobile Development

UX/UI Design

Staff Augmentation

CTO as a Service

Dedicated Team

Low code development

Accounting Software Development Services

We develop custom accounting software that helps businesses automate financial workflows, centralize data, and keep full control over reporting and data.

Custom Accounting Software Development Services We Provide

Custom Accounting Software Development

We build accounting systems that fit your business structure, processes, and reporting needs.

Accounting Platform Modernization and Migration

We move your old systems and spreadsheets to modern platforms, ensuring a clear structure and safe data transfer.

Integration with ERP, CRM, and Banking APIs

Our team can connect your accounting system with ERP tools, CRMs, and banking APIs so your financial data stays in sync.

Accounting Automation and RPA

Manual operations such as approvals, reconciliations, and data entry are automated to reduce routine work.

Reporting, Dashboards, and Analytics

Our custom dashboards give you a clear view of your financial performance and key metrics.

Mobile and Web Portals for Accounting

We develop secure web and mobile interfaces for finance teams, managers, and external stakeholders.

Support, Maintenance, and SLA

Our team provides ongoing support to keep your system stable, up to date, and responsive.

Consulting and Solution Architecture

We work with you to plan your accounting workflows, system setup, and technical design before development begins.

Projects Delivered by Our Team

Myntkaup

A cryptocurrency trading platform that allows users in Iceland to trade and manage digital assets securely.

MuesliSwap

A decentralized exchange platform where users can trade, swap, and stake cryptocurrencies directly from their wallets.

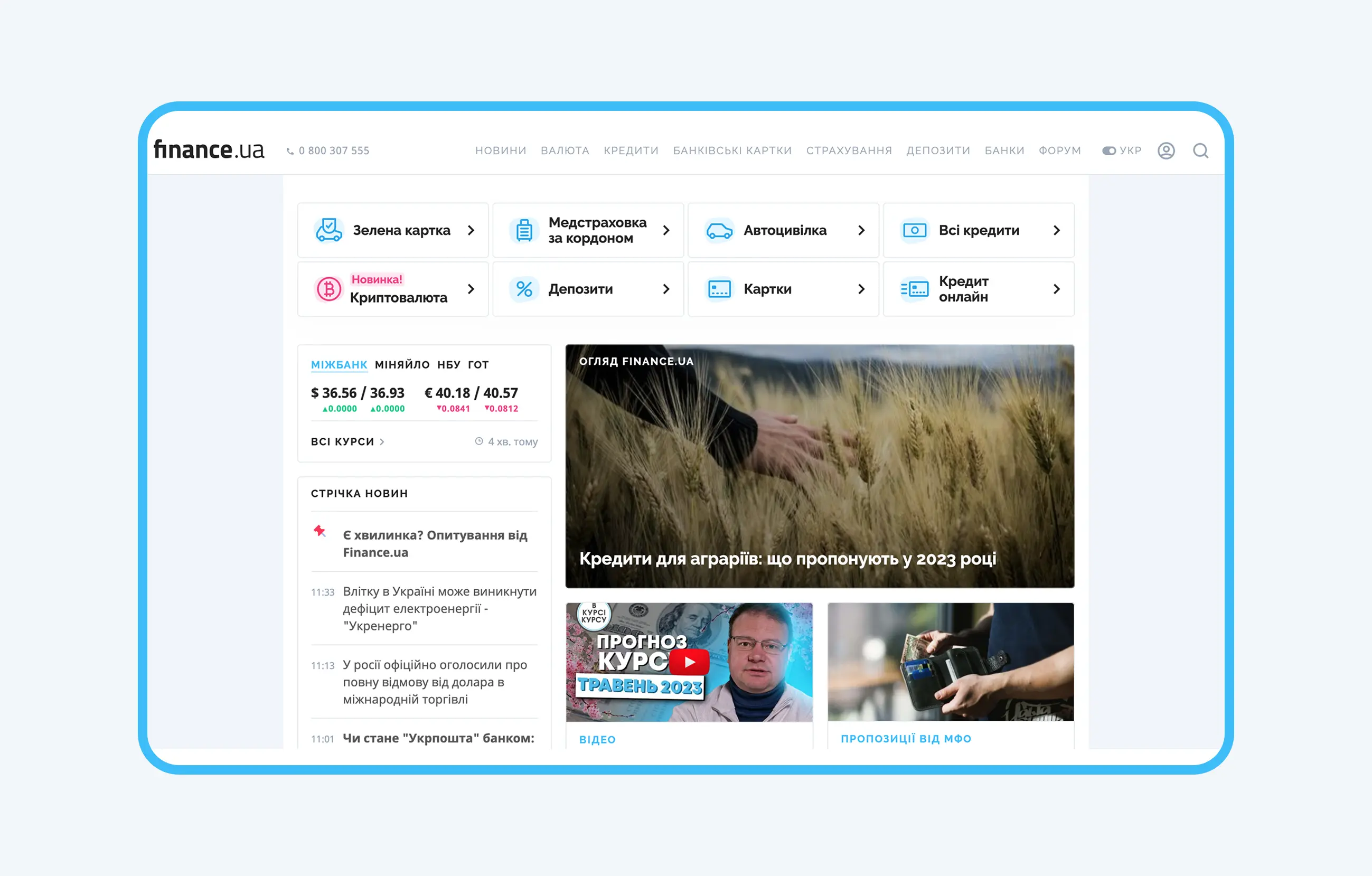

Finance.ua

Ukraine’s leading financial portal with 5 million monthly visitors.

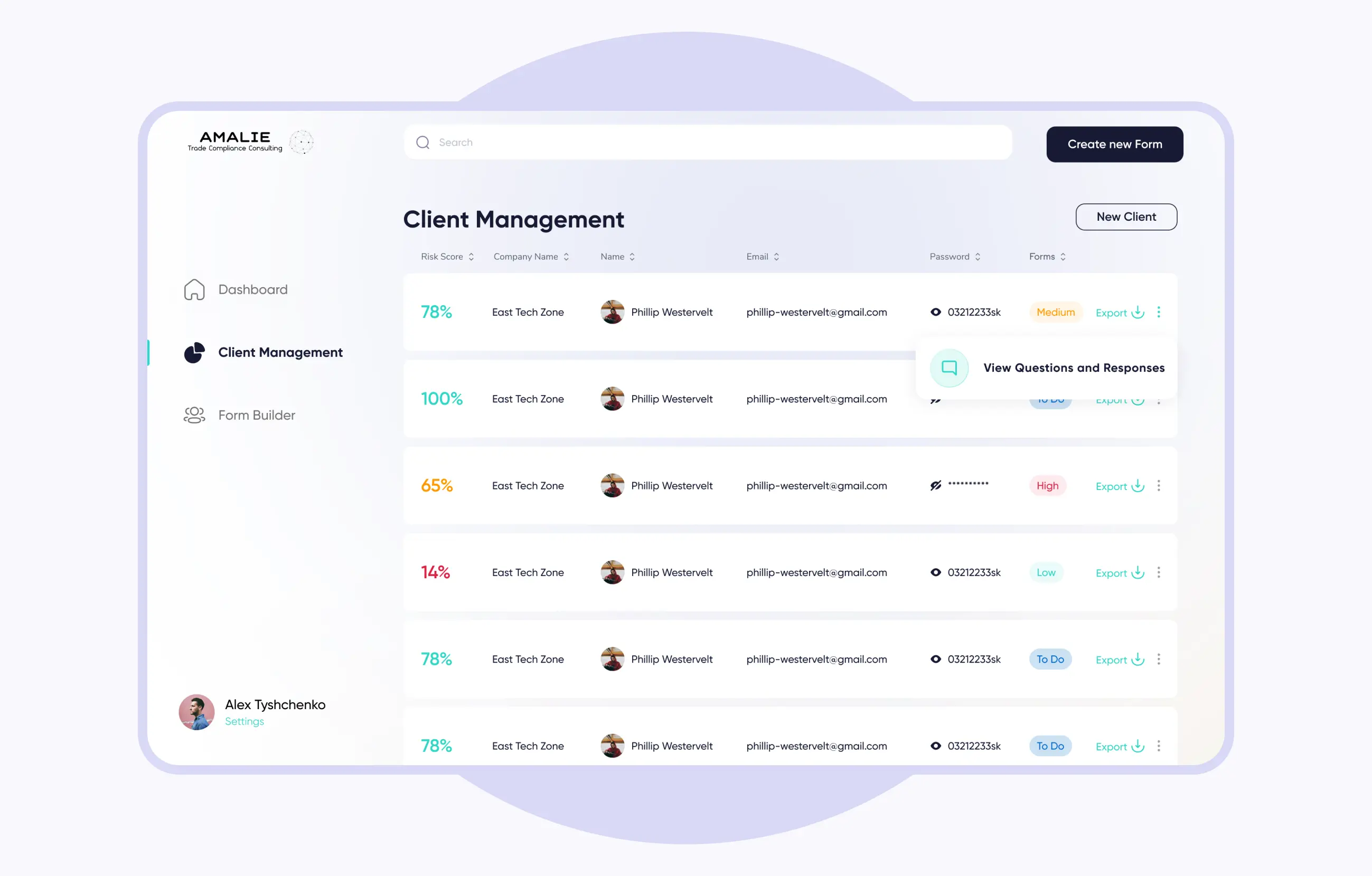

Amalie

Web form builder that automates data collection and risk scoring for a US-based consulting firm

Core Accounting Features We Build

General Ledger and Chart of Accounts

Clear account structures and ledgers that support everyday accounting and accurate reporting.

Accounts Payable and Accounts Receivable

Management of invoices, payments, and balances for both incoming and outgoing transactions.

Invoicing, Billing, and Collections

Custom billing logic with recurring invoices, payment tracking, and collection workflows.

Bank Feeds and Reconciliation

Automatic import of bank transactions with reconciliation against internal records.

Cash Flow, Budgeting, and Forecasting

Tools for tracking cash movement, planning budgets, and building financial forecasts.

Fixed Assets and Depreciation

Asset management with depreciation rules and full asset lifecycle tracking.

Inventory and Cost Accounting

Cost tracking for goods, stock movement, and inventory-related expenses.

Payroll and Expense Management

Employee expenses, reimbursements, and payroll-related calculations.

Audit Trails, Approvals, and Controls

Detailed action history, approval flows, and internal financial controls.

Multi-Entity, Multi-Currency, and Tax

Support for multiple legal entities, currencies, and regional tax rules.

Get a Consultation with Senior Accounting Software Developers

Talk to Stubbs specialists and get clear technical guidance before starting accounting software development.

Name

Accounting Software Integrations

ERP and PSA Systems

Integration with enterprise systems to synchronize financial data, projects, and operations.

CRMs

Connection with CRM platforms to align sales data, invoices, and customer payments.

Payment Gateways

Integration with payment providers to track transactions and automate payment workflows.

Banking and Open Banking APIs

Direct connections to banks for transaction import, balances, and reconciliation.

eCommerce and Marketplaces

Financial data sync from online stores and marketplaces into accounting systems.

BI and Data Warehouses

Export of accounting data for advanced reporting and business analysis.

Document Management and eSignature

Storage, approval, and signing of financial documents within connected systems.

Team

Security and Compliance

1

Role-Based Access, SSO, and MFA

Our specialists configure access rights by roles and set up single sign-on and multi-factor authentication.

2

Data Protection and Encryption

Financial data stays protected through encryption in transit and at rest, with controlled access to sensitive information.

3

Security and Regulatory Readiness

System architecture is designed to support common regulatory and security requirements used in financial software.

4

Audit Readiness and Retention Policies

Audit logs, data history tracking, and retention rules help support internal reviews and external audits.

Technology Benefits

1

Scalable Cloud Architecture

The system can manage more data, users, and transactions as your business grows, without slowing down.

2

High Performance and Reliability

A stable backend keeps daily accounting tasks and important financial processes running smoothly.

3

Flexible Data Models

The data setup can adjust to fit your business rules, reporting needs, and financial processes.

4

API First Design

Open APIs simplify integrations with banking systems, ERP platforms, and external services.

Stages of work

Industries We Serve

Professional Services and SaaS

Accounting systems for service companies that want clear reporting, automated billing, and reliable financial workflows.

E-commerce and Retail

Support for orders, payments, refunds, and reconciliation across multiple sales channels.

FMCG and Logistics

Tools for cost tracking, inventory accounting, and financial reporting across supply chains.

Banking and Fintech

Accounting platforms connected with payments, transactions, and financial data sources.

Web3 and Crypto

Financial systems for crypto products, exchanges, and Web3 platforms, including transaction tracking and reporting.

Healthcare and Nonprofit

Systems designed to handle budgeting, reporting, and controlled financial processes.

Why Choose Our Accounting Software Development Company

1

Domain Expertise in Finance and Operations

Our team works with accounting logic, financial workflows, and reporting systems as part of broader fintech development services. This experience helps avoid common mistakes and design solutions that fit real business processes.

2

Proven Delivery of Custom Accounting Software

We design and deliver accounting platforms built to match specific workflows, data structures, and reporting needs of each business.

3

Flexible Cooperation Models

You can work with a dedicated specialist, a full development team, or receive ongoing support. We adjust our approach to fit your goals.

4

Security First and Compliance Ready

We focus on security, access control, and audit needs right from the start of development.

5

Transparent Estimation and Clear SLAs

A clear scope, realistic timelines, and open communication help keep your project on track.

Questions You May Have

What does an accounting software development company do?

Such teams design and build systems that help businesses manage accounting workflows, reporting, integrations, and financial data in one platform.

How do you estimate the cost and timeline for custom accounting software development?

We estimate costs and timelines based on the features you need, integrations, data complexity, and user roles. Once we review your requirements, we’ll give you a clear plan, schedule, and budget.

Can you migrate from spreadsheets or legacy systems without data loss?

Yes. We plan data migration carefully to keep your historical records safe and make sure everything stays consistent during the move.

Which integrations do you support for banking, ERP, and payments?

Accounting systems can be connected with banking APIs, ERP platforms, payment providers, and internal tools your team already uses.

How do you ensure security, auditability, and compliance?

We build in access control, encryption, activity logs, and approval steps from the start.

What tech stack do you recommend for accounting software development?

The technology we choose depends on your needs and scale. Usually, we use modern backend frameworks, reliable databases, and cloud infrastructure.

Do you offer ongoing support, upgrades, and training?

Yes. Many clients keep working with us after launch to improve workflows, add new reports, and adjust the system as their business changes.

How do you handle multi-entity, multi-currency, and tax rules?

We set up the system to handle multiple legal entities, different currencies, and flexible tax rules to fit your business.

What reporting and analytics options can you implement?

We can build custom reports, dashboards, exports, and connect with BI tools, depending on how you use your data.

What is your process to start a custom accounting software development project?

We start with a discovery phase to define your workflows, goals, and any constraints. This helps us reduce risks and make sure we focus on what matters most to you.

We would love to help.

What are you interested in:

Name

Phone

Tell us about your project and goals

0/1000

Add your file